Article

2024/12/02

Natural Environment Management and Corporate Resilience: Strengthening Value Chain Management By the TNFD Framework

-

Copied to clipboard

The 2022 United Nations Biodiversity Conference (CBD COP15) established the "Kunming-Montreal Global Biodiversity Framework," which set Nature Positive targets for global environmental protection and biodiversity restoration. This decision has initiated widespread attention towards biodiversity and natural environment issues. The introduction of the "Kunming-Montreal Global Biodiversity Framework" has not only prompted governments to promulgate proactive management policies but also guided capital markets and enterprises to reassess the risks and opportunities that biodiversity presents to their operations.

The natural risks and opportunities faced by companies depend on the type of industries. For example, primary industries such as agriculture, forestry, and food heavily depend on natural resources for their raw material supply. Changes in natural capital directly impact their operational stability, thereby affecting the performance of these industries.

In addition to the impact of raw material supply, policy risk is another critical area of concern for companies. With countries gradually implementing commitments under the "Kunming-Montreal Global Biodiversity Framework," governments are enacting more proactive regulations. For instance, France's Energy and Climate Law requires publicly traded companies or those with a turnover of 40 million euros to disclose biodiversity risks, and the UK’s Green Finance Policy mandates the disclosure of environmental impact risks. This means that large enterprises will face stringent compliance pressures.

As the external focus on natural issues intensifies, proper management and disclosure of nature-related risks have become essential management directions for companies. For example, the 2024 revision of the Global Reporting Initiative (GRI) will include more detailed biodiversity disclosure guidelines, following the Taskforce on Nature-related Financial Disclosures (TNFD) framework. Additionally, the Carbon Disclosure Project (CDP) has added water resources and biodiversity-related questions to its climate questionnaire, encouraging companies to simultaneously address climate change and biodiversity.

However, the impact of the natural environment on businesses is not limited to risks but also presents development opportunities. Companies that develop environmentally friendly services and products can attract consumer purchases.

To assist companies in systematically assessing and managing nature-related risks and opportunities, the United Nations Development Program (UNDP), United Nations Environment Program Finance Initiative (UNEP FI), World Wildlife Fund (WWF), and the non-profit organization Global Canopy jointly launched the TNFD framework. This framework follows the four pillars of the Task Force on Climate-related Financial Disclosures (TCFD)—governance, strategy, risk management, and metrics & targets—to help companies more effectively address the complexity of natural issues. The TNFD framework differs from TCFD in three key areas:

- Local Governance: Beyond the involvement of senior management, it requires companies to consider human rights issues and respect the contributions of local indigenous peoples and communities to natural issues.

- Regional Differences: Natural issues emphasize regional differences, requiring companies to manage and implement action plans tailored to local conditions.

- Value Chain Impact Assessment: Companies need to assess their dependence on and impact on the natural environment throughout their value chain, utilizing the LEAP methodology (Locate, Evaluate, Assess, Prepare).

The TNFD reporting framework is expected to become a fundamental basis for future international sustainability disclosure standards such as the Global Reporting Initiative (GRI), International Financial Reporting Standards (IFRS), and European Sustainability Reporting Standards (ESRS), aiding companies in more efficiently disclosing nature-related risks.

Since 2008, ASUS has systematically managed natural issues, achieving ISO14001 environmental management system certification for its operations and supply chain. In 2018, ASUS published the first Environmental Profit and Loss (EP&L) report in the technology industry, covering products that account for 90% of its revenue, identifying key indicators and management guidelines, demonstrating its commitment to the natural environment. To further effectively manage nature-related risks and opportunities, ASUS follows the TNFD disclosure guidelines, conducting environmental analyses based on the four pillars of governance, strategy, risk management, and metrics & targets, incorporating biodiversity issue identification, formulating biodiversity policies, integrating them into supply chain management, and promoting action projects.

Governance: Board Supervision and Cross-departmental Collaboration

Following the establishment of the "Kunming-Montreal Global Biodiversity Framework" at the 2022 United Nations Biodiversity Conference (CBD COP15), which set more specific goals and actions compared to the 1992 "Convention on Biological Diversity," it has helped companies incorporate these into their management scope. As a multinational corporation, ASUS is responsible for addressing complex compliance and brand reputation risks. Considering the aforementioned circumstances, ASUS has incorporated natural issues into its sustainable management system, with direct supervision by the board of directors. The chairman has assigned the CEO as the highest responsible management level for sustainable management, with the ESG Management Committee, Sustainability and Green Quality Management Center, and Green ASUS & SERASUS Committees conducting horizontal communication and management of natural environment and supply chain issues.

Strategy: Actions Within and Beyond the Value Chain

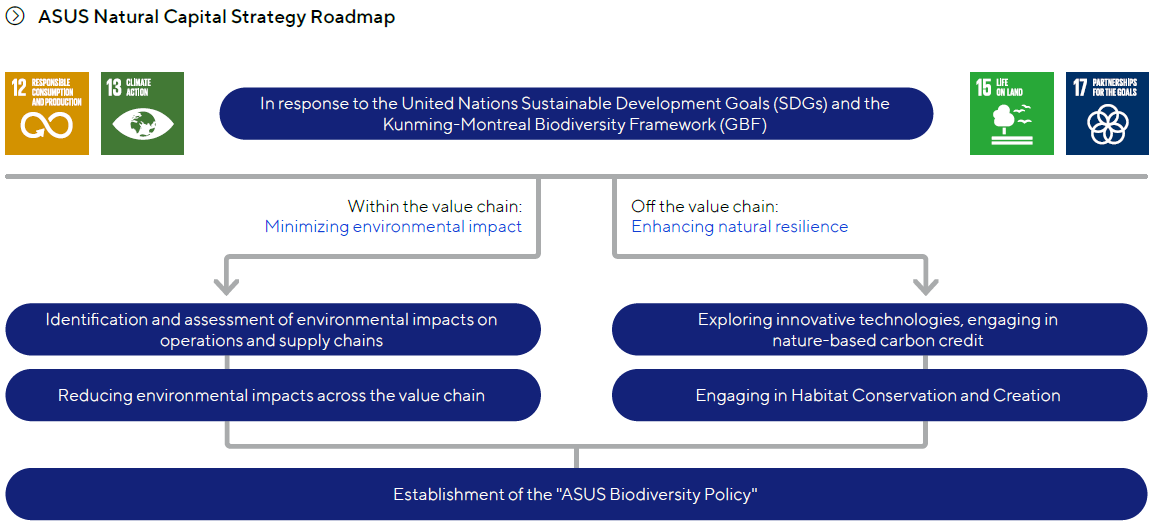

ASUS has built ASUS Natural Capital Strategy Map based on two main pillars: " Within value chain" and "Beyond value chain". Within the value chain management, ASUS published its first Natural Impact Assessment Report this year, explaining the impact of its operational activities and supply chain on the environment and biodiversity. Externally, through engage in the "Daxue Mountain Middle-Altitude Pangolin Habitat Enhancement and Conservation Project", ASUS applies data-driven thinking to further manage potential natural risks and develop innovative business opportunities.

Risk Management: Two-stage LEAP Analysis

Following the TNFD disclosure framework, ASUS included its operational sites and upstream supply chain in this assessment. According to research by Morgan Stanley Capital International (MSCI) and the international natural risk database ENCORE (Exploring Natural Capital Opportunities, Risks, and Exposure), ASUS's dependence on natural capital is relatively low. Therefore, based on resource allocation principles, ASUS prioritizes managing environmental impacts.

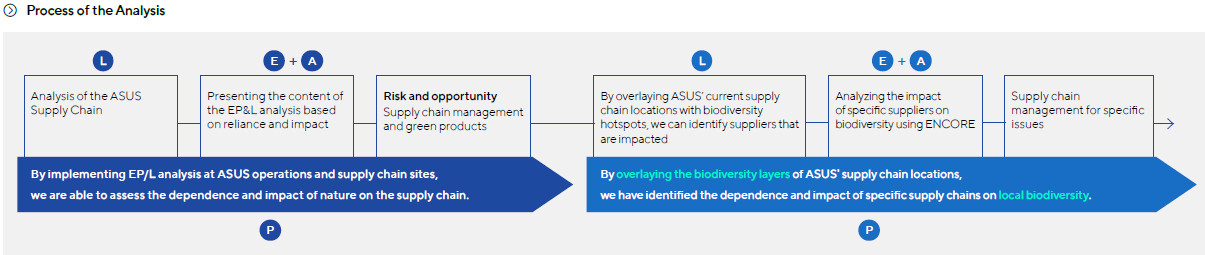

During the analysis process, ASUS adopted a two-stage LEAP analysis to cover the value chain's impact assessment on the environment. In the first stage, ASUS integrated operational sites and supply chain locations, using environmental profit and loss analysis to assess impact factors (water pollution, air pollution, solid waste, water resource utilization) and monetize them. It was found that water pollution had the highest impact, followed by greenhouse gases, waste, and water resource utilization.

Continuing from the first-stage analysis, ASUS identified water pollution, the highest impact factor, as the priority identification factor. By overlaying biodiversity hotspot maps on operational sites and upstream supply chains, ASUS further analyzed whether these sites affected biodiversity and managed potentially impactful locations.

For example, ASUS prioritized identifying key biodiversity locations and areas potentially affected by suppliers, using secondary research data to identify species that may be impacted and leveraging database monitoring to map possible impact pathways. Once the potential impact scope was confirmed, ASUS included the supplier in this year's on-site audit targets to ensure proper management of water pollution-related emissions and processes. The analysis showed that a few suppliers were near key biodiversity areas. ASUS required these suppliers to obtain ISO14001 environmental management system certification and SA8000 social responsibility certification. ASUS will enhancing water pollution management to reduce the environmental impact of supply chain activities.

Metrics & Targets: Quantifiable, Achievable, and Trackable Management Goals

For operational sites and upstream supply chains, ASUS has established management guidelines and actions for four major impact indicators: water pollution, air pollution, solid waste, and water resource utilization. For example, operational sites aim to save 1% water annually, and 100% of suppliers must obtain ISO14001 certification to strengthen the supply chain's environmental footprint management. Based on identification results, ASUS will continue to enhance water footprint management, manage related issues using scientific reduction pathways, expand recycling mechanisms to strengthen product waste management, and promote other actions that may impact the natural environment.

ASUS believes that companies intending to engage in nature and biodiversity issues should first determine whether their industry is highly related to natural issues. Additionally, they need to identify internal and external stakeholders' pressure sources and emerging issues to assess the individual risks and opportunities posed by natural issues to their operations or upstream and downstream value chains. Once risks and opportunities are identified, companies should establish systematic assessment and management mechanisms, evaluate the financial impact on the company, and set reasonable goals and pathways based on the assessment results.

Besides implementing management within value chain, engage the project beyond value chain is key to ASUS's natural positive journey. The Taiwanese pangolin faces habitat degradation, compressing its living space and causing its population to decline. In 2019, the International Union for Conservation of Nature (IUCN) Red List classified it as Critically Endangered (CR). ASUS, in collaboration with Kuan-Shu Education Foundation and Dr. Sun Ching-Min from National Pingtung University of Science and Technology, participated in the "Daxue Mountain Middle-Altitude Pangolin Habitat Enhancement and Conservation Project." The project aims to raise public awareness of pangolin conservation, invite local communities to participate in protection actions, and provide monitoring equipment to prevent further habitat destruction through technological innovation. Collaboration between the community and technology will help improve the survival environment for pangolins.

Related Article